overview

Exchange houses with Infinite e-sign suite

For decades, exchange houses in the UAE have been providing affordable and reliable remittance and payment solutions to the country’s diverse expatriate population. By continually evolving with customer needs and demands, we have built lasting relationships based on trust and credibility with expatriates from all over.

Challenges

Industry challenges

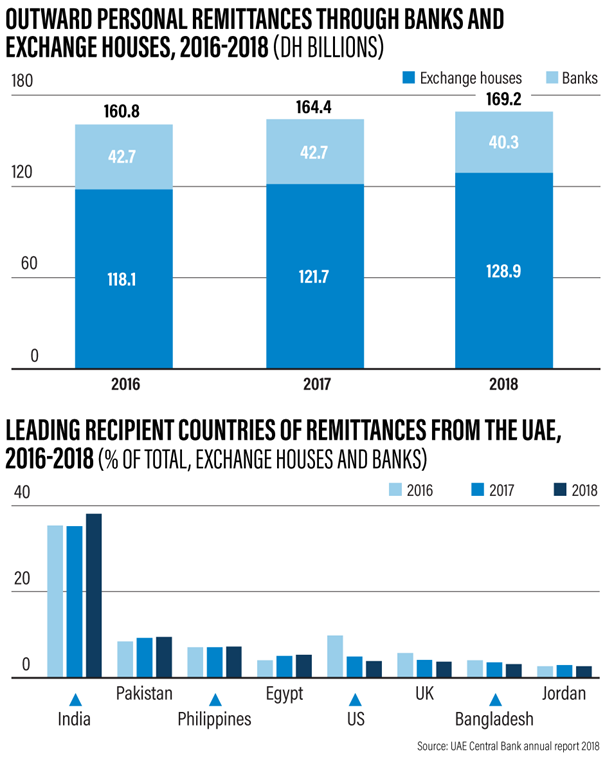

Outward personal remittances reached Dh169.2 billion last year, an increase of 3 per cent or Dh4.8bn compared to 2017, according to the UAE Central Bank’s annual report released this week.

Money sent home through exchange houses increased by 6 per cent from Dh121.6bn in 2017 to Dh128.9bn last year, while the amount sent through banks decreased by 5.6 per cent from Dh42.7bn to Dh40.3bn.

The highest share by far went to India, accounting for 38.1 per cent of the total outflows, “in accordance with the significant share of expats from India working in the UAE and the depreciation of the Indian rupee against the dirham”, the report said. Indian nationals account for about 30 per cent of the UAE’s total expatriate population, according to the Indian Embassy in Abu Dhabi.

The next five top countries receiving remittances from the UAE were Pakistan (9.5 per cent), the Philippines (7.2 per cent), Egypt (5.3 per cent), the US (3.9 per cent) and the UK (3.7 per cent).