Arabia – Fullfill all regulations

e-invoicing

in Saudi Arabia

We’re officially certified by ZATCA

Infinite ZATCA E-Invoicing Suite Benefits:

- Full ZATCA Integration: Seamlessly connect to ZATCA’s Phase 2 regulations through our middleware solution or file upload portal.

- Flexible Invoice Upload: Upload invoices in bulk or individually using formats such as PDF, Excel, and CSV.

- Real-Time Invoice Tracking: Monitor the status of your invoices in real-time through our easy-to-use ZATCA monitoring portal.

- Comprehensive Support: Our solution covers onboarding, API integration, project management, and user acceptance testing (UAT) to ensure a smooth and successful setup.

Why Choose Infinite IT Solutions?

- Certified ZATCA Provider: With over 20 years of experience, Infinite IT Solutions is a trusted partner for businesses across Europe and the Middle East, providing industry-leading solutions for ZATCA compliance.

- End-to-End Service: From full API integration to ongoing maintenance, we offer everything you need to stay compliant with ZATCA regulations.

- Trusted by Leading Businesses: Companies like Redington KSA and Lynx Contracting trust Infinite IT Solutions to meet their e-invoicing and e-archiving needs efficiently and effectively.

Trusted by leading companies in the Middle East

Join the growing list of businesses that rely on us to drive success, innovation, and growth in the region.

Client Success Stories

Our proven solutions have helped businesses such as Redington KSA or Lynx Contracting achieve compliance, streamline operations, and save costs:

Salman Ali, Finance Manager, Lynx Contracting:

“The Infinite ZATCA E-Invoicing Suite saved us significant costs without requiring us to change our ERP system.

Their seamless integration was a game-changer.”

Ajay Kumar, ERP Specialist, Redington KSA:

“Infinite’s ZATCA Suite enables us to send real-time data to ZATCA, making our B2B transactions faster and more efficient.”

Want to know more about ZATCA e-invoicing?

Download our newest ebook.

Inside you can find interesting facts, expert opinions, timeline and a lot of tips.

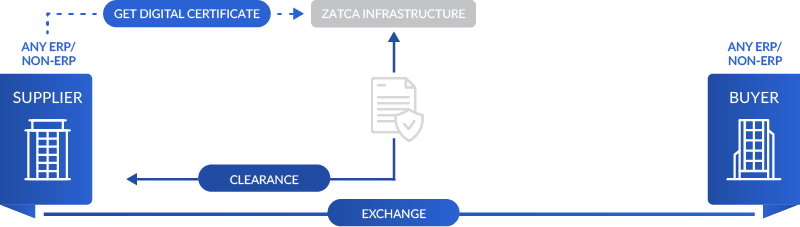

what the new ZATCA process looks like

ZATCA e-invoicing process

QUESTIONS ABOUT ELECTRONIC INVOICING? WE HAVE ANSWERS

Most frequentl questions

Why should i implement e-invoicing?

There are multiple reasons in favour of implementing electronic invoicing. The main ones are:

- The new regulations announced by ZATCA making the e-invoicing mandatory from December 4th, 2021

- Financial transparency

- Compliance with e-invoicing regulations

- Reduced procure-to-pay cycles

- Automated invoice registration via API / EDI

- Reduced operational costs

How long does it take?

The deployment of e-invoicing solution takes on average from 2 weeks to 6 weeks. The ready-to-deploy connectors shall just need to be customised towards a business specification as they are already configured meeting the ZATCA’s regulations.

Are there any penalties if i don't adopt e-invoicing?

There are currently no penalties applicable. However, the non-compliance penalties stipulated in the VAT Law will be applicable at the end of the grace period (December 4th, 2021).

Who is subject to the Electronic Invoicing Regulation?

All taxable persons for VAT purposes (excluding non-resident taxable persons), in addition to any other party issuing tax invoices on behalf of a supplier subject to VAT.

How will Electronic invoicing be implemented?

The implementation of Electronic Invoicing has two main phases:

1. Phase One: Generation and storing of tax invoices and electronic credit or debit notes in a structured electronic format issued through an electronic solution, and including all the requirements of tax invoices.

2. Phase Two: Integration of the taxable persons’ electronic solution used to generate electronic invoices and credit or debit notes, with ZATCA’s systems, with the objective of sharing data and information.

What actions should be taken now to start the Electronic Invoicing journey?

The first step is to determine whether the Electronic Invoicing Regulation applies to you, as well as assessing how ready you are to generate electronic invoices as per the minimum requirements outlined in the Regulation.

The second step is to determine whether you have capabilities to meet the regulations with your internal resources who shall complete the deployment within the grace period (December 4th, 2021).

The alternative is to engage a system integrating company like Infinite IT Solutions which provides the 100% compliant e-invoicing solution. The deployment is arranged from 2 to 6 weeks on average.

What is meant by “Electronic Means” in the definition of Electronic Invoice in the Electronic Invoicing Regulation?

Any device, electronic solution, or application used for the generation of electronic invoices and credit or debit notes that meets the following minimum requirements:

- Ability to connect to the Internet.

- Compliance with the requirements and controls for data & information security or Cybersecurity in the Kingdom.

- A tamperproof solution, which allows the detection of any tampering performed.

- Ability to integrate with external systems using Application Programming Interface (API).

How can I establish Application Programming Interface (API) to connect with the ZATCA’s platform?

The first step is to determine whether you have capabilities to set up the connection and meet the regulations with your internal resources who shall complete the deployment within the grace period (December 4th, 2021).

The alternative is to engage a system integrating company like Infinite IT Solutions which provides the 100% compliant e-invoicing solution via ready-to-deploy API connectors. The deployment is arranged from 2 to 6 weeks on average.

How are Electronic Invoices recorded? Are there any requirements for record-keeping purposes?

Provided that the Electronic Invoice is considered a tax invoice in accordance with the provisions of the VAT Law and its Implementing Regulation, all the provisions that apply to tax invoices shall apply to electronic invoices, including the rules of keeping (storing) tax invoices stipulated in the VAT legislations, and specifically Article (66) of the VAT Implementing Regulation.

The archiving periods of e-invoices:

- 6 years (standard assets)

- 11 years (moveable and intangible capital assets)

- 15 years (real estate)

Infinite IT Solutions provides a long term, 100% ZATCA-compliant archiving service. The authenticity of invoice origin and the integrity of invoice content are guaranteed. Invoice data cannot be altered thanks to the qualified time stamp.

What languages are available for dealing and issuing an Electronic Invoice?

An electronic invoice needs to be issued in Arabic; however, other languages can be used in addition to the Arabic language.